Bracket Orders In Cryptocurrency

Effectively bracket orders allow your run-of-the-mill day trader to use logic and implement a high-frequency trading strategy. Now lets see how things would have turned out differently if you had placed a bracket order.

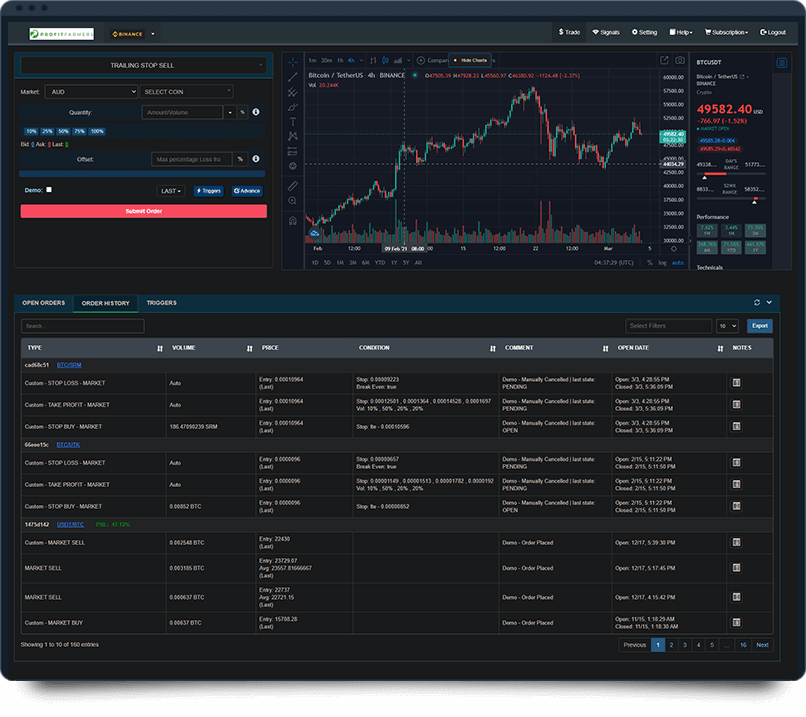

Bracket Order How To Place On Cryptocurrency Exchange Trailingcrypto

While common in the world of equities and futures bracket orders are rare in the world of cryptocurrencies.

Bracket orders in cryptocurrency. One order to open a position long or short and two trigger orders for take profit and stop loss. Bracket orders let investors buy an asset and simultaneously create two sell orders. A chain bracket its just what it sounds like a three dimensional chain versus a blockchain which is only two dimensional.

For a stop and a take profit. Phemex launched less than a year ago but has quickly grown into one of the most liquid crypto exchanges. Currently bracket orders also known as a One Triggers a One Cancels Other OTOCO order or a One Cancels Other OCO order may be placed using the tastyworks desktop platform when using the Table or Curve mode in the Trade tab.

However it is essential to master the art of identifying support and resistance levels or having expert assistance. The bracket order form allows you to place three orders simultaneously. Support and resistance indicators play a crucial role in determining a traders profit or loss in a given trade.

You can set a Bracket Order and enter the market at INR 008. Understanding Bracket Orders A New Trading Tool CoinFLEX recently announced a hybrid manualautomated form of scalping orders called bracket orders for its trading interface. When the parent order is filled the sub-bracket orders will be activated.

The future of digital assets statistics videos and images compiled into a bracket coin. The opening order can be a limit order or a market order. Bracket Orders allow you to define profit as well as set downside protection.

The BTC-USD contract alone routinely records over 5 billion in monthly volume. The first order is used to enter a new long or short position and once it is completely filled two conditional exit orders are activated. The TP and SL orders are initially inactive until the PO becomes fully filled.

This helps traders lock in their profits and minimise their loss at the same time. Phemex is now the first crypto derivatives exchange to offer a Bracket Order. Opening limit orders can be set as maker-only.

A bracket order is another type of order that is available to margin traders on CoinDCXs platform. Entries and risk management are combined into a single task saving time and frustration. A Developing Playground for Traders.

Entry Order Exit Order Target Order and Trailing Stop Loss Order. The trader will select the value they want to profit by as. In this case first your buy order will get executed then a sell order will be placed by the system.

So you can set a target limit order at INR. Bracket orders are also known as custom order-send-ordercustom OSO as per the above explanation. You set the entry order at 30 INR target order at 35 INR and stop limit order at 28 INR with a trail of 20 paisa.

Expected price according to your analysis is INR 011. Bracket orders stop-losstake-profit orders can be used to exit an existing position. Traders can use bracket orders when using resistance levels for shorting.

A bracket order is a chain of three orders that can be used to manage your position entry and exit. Executing a bracket order through custom OSO on crypto exchanges through TrailingCrypto. The opening order can be a limit order or a market order.

Bracket Orders Buy side Basically Bracket Orders are a combination of three orders. Bracket Orders The bracket order form allows you to place three orders simultaneously. It is an order type where traders can enter a new position along with a targetexit price and a stop-loss order.

One order to open a position long or short and two trigger orders for take profit and stop loss. A bracket order is an advanced order which has three orders merged into one. A bracket coin is a coin that exists on a chain bracket.

Bracket coin and bracket chain is. When using this order type each order will be accompanied by an OCO One Cancels the Other. TrailingCrypto does not have a direct option for a bracket order in the menu for selecting the order type.

A Bracket Order BO is represented by a Limit Order or primary order PO that comes attached with two exits. It is a common use case of an OTOCO One Triggers OCO One Cancels Other order. A Take Profit TP limit order plus a Stop Loss SL limitmarket order.

However you can still use the available options to customize your order into a bracket order. Please refer to the video above or continue to the written instructions below to learn how to set up an OTOCO or OCO order in your. The answer is Bracket Order.

It also can be submitted with a parent order. Where you start with choosing a token pair defining its buy price sell price and stop loss with trailing points. Current price of BTT is INR 008.

Ez25coin Blockchain Technology Blockchain Solving

The Ultimate Guide To Cryptocurrency Trading Bots

Bracket Order How To Place On Cryptocurrency Exchange Trailingcrypto

How Oco Order Works On Cryptocurrency Exchanges Trailingcrypto Medium

Most Popular Cryptocurrency Exchanges Platforms In India

Empilable Ordinateur Renommee 14 Carte Graphique Gpu Usb Pci E Cable Ordinateur Cas Btc Ltc Coin Mining Cadre Serve Carte Graphique Cable Ordinateur Ordinateur

Komainu To Store Crypto Confiscated By Uk Law Enforcement In 2021 Best Cryptocurrency Custody Securities And Exchange Commission

Bitcoins Bitcoininvestingforbeginners Bitcoin Coin Logo Cryptocurrency

Cryptocurrency Trading Goes To The Next Level With Bracket Orders Market Insights

72 Cryptocurrency Statistics Show Crypto S Gone Mainstream

Crypto S Trading Trader Forex Stock Bitcoin In 2021 Cryptocurrency Bitcoin Blockchain Technology

Bracket Trading The Most Profitable Approach For Trading Cryptocurrency Itsblockchain

Crypto Derivatives Trading Types Of Orders Delta Exchange

An Advanced Cryptocurrency Trading Terminal

Fundamental Macro Trading Arbitrage Trading Automated Trading Cryptocurrency

Whizcoin Blockchain Cryptocurrency Ico

Joe Waiganjo On Twitter Earn Money Online Investing Cryptocurrency