Federal payroll tax calculator 2023

There are seven federal tax brackets for the 2021 tax year. Americas 1 tax preparation provider.

Capital Gains Tax Calculator 2022 Casaplorer

Self-Employed defined as a return with a Schedule CC-EZ tax form.

. The Pennsylvania sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the PA state sales tax. States and cities that impose income taxes typically have their own brackets with rates that tend to be lower than the federal governments. Self-Employed defined as a return with a Schedule CC-EZ tax form.

If you acquire ownership of a home as part. Americas 1 tax preparation provider. 1040 Tax Estimation Calculator for 2022 Taxes.

If your EOD falls between July 1 and December 31 you will receive your increment in July 2022. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The RD Tax Credit 26 US.

Before you choose to outsource any of your payroll and related tax duties that is withholding reporting. Code 41 also known as the Research and Experimentation RE tax credit is a federal benefit that provides companies dollar-for-dollar cash savings for performing activities related to the development design or improvement of products processes formulas or software. Like the Federal Income Tax Kansas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Items such as groceries household paper products medicine and clothes are exempt from all sales taxes. 1 online tax filing solution for self-employed. 1 online tax filing solution for self-employed.

The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Montana Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Montana. 10 12 22 24 32 35 and 37.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 1 online tax filing solution for self-employed. When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or.

Enter your filing status income deductions and credits and we will estimate your total taxes. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Must contain at least 4 different symbols.

1 online tax filing solution for self-employed. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Your bracket depends on your taxable income and filing status.

Certain businesses located within Urban Enterprise Zones including Salem County are required to only collect a reduced sales tax of 50 the state sales tax rate. Americas 1 tax preparation provider. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Groceries and prescription drugs are exempt from the Ohio sales tax. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

California has the highest state income tax at 133 with Hawaii 11 New Jersey 1075 Oregon 99 and Minnesota 985 rounding out the top five. Americas 1 tax preparation provider. Gasoline purchases are not subject to the New Jersey Sales Tax but a Gasoline Excise Tax does apply.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. There have been several major tax law changes as of tax year 2013 including several that are the result of new Obamacare-related taxes. Kansas collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Counties and cities can charge an additional local sales tax of up to 225 for a maximum possible combined sales tax of 8. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Americas 1 tax preparation provider. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Missouri local counties cities and special taxation districts. Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

These are the rates for taxes due. Self-Employed defined as a return with a Schedule CC-EZ tax form. Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the.

If you would like to get a more accurate property tax estimation choose the county your property is. 1 online tax filing solution for self-employed. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Americas 1 tax preparation provider. If your profit exceeds the 250000 or 500000 limit the excess is typically reported as a capital gain on Schedule D. This credit provides much needed cash to.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Exemptions to the Pennsylvania sales tax will vary by state. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

1 online tax filing solution for self-employed. State regular employees who are otherwise eligible will receive an increment on July 1 2022 or January 1 2023 based on the employees entry-on-duty EOD date. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Free 2022 Employee Payroll Deductions Calculator. ASCII characters only characters found on a standard US keyboard.

1 online tax filing solution for self-employed. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

Americas 1 tax preparation provider. 6 to 30 characters long. Kansas maximum marginal income tax rate is the 1st highest in the United States ranking directly.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Federal calculations will now use the official federal tax brackets and deductions and state calculations will use the most recent brackets available.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Americas 1 tax preparation provider.

Key Takeaways If you owned and lived in the home for a total of two of the five years before the sale then up to 250000 of profit is tax-free or up to 500000 if you are married and file a joint return. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Self-Employed defined as a return with a Schedule CC-EZ tax form. 1 online tax filing solution for self-employed.

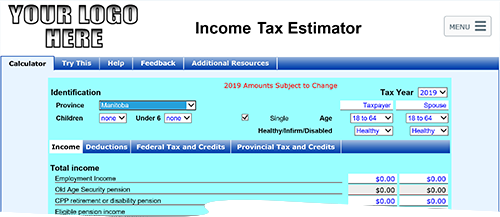

Knowledge Bureau World Class Financial Education

2021 2022 Income Tax Calculator Canada Wowa Ca

Manitoba Income Tax Calculator Wowa Ca

Your 2022 Tax Fact Sheet And Calendar Morningstar

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

Salary Tax Calculator For Pakistan Fy 2021 22 Youtube

New Income Tax Rates Calculation Fy 2020 21 Income Tax Slabs Income Tax Calculator 2020 21 Youtube

How To Calculate Foreigner S Income Tax In China China Admissions

Simple Tax Calculator For 2022 Cloudtax

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Tax Calculator Estimate Your Income Tax For 2022 Free

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022